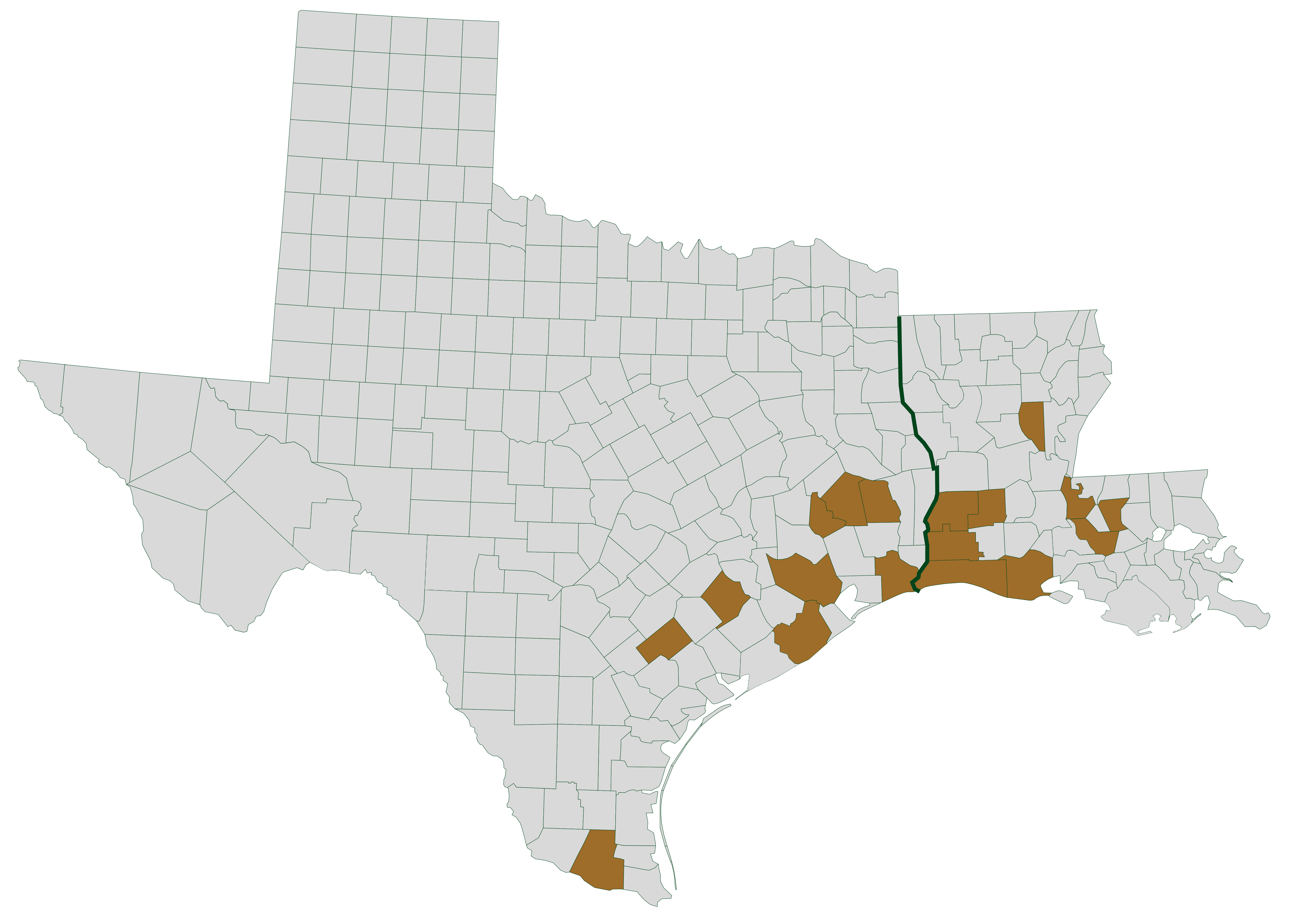

WHERE WE OPERATE

Lucky Lad Energy Operates Conventional, Producing Oil and Gas Wells Along The Texas and Louisiana Gulf Coast

Our Process

Our management team has experience implementing our process across multiple operators and operating areas

We strive to acquire producing or high potential assets at an attractive price. We have become a preferred partner with operators looking to divest their late life assets before they are marketed, allowing us to acquire for attractive prices while closing quickly to reduce the burden on operators.

After acquisition, the real work begins. We evaluate historic well production and previous wellwork to find opportunities to invest capital in workovers, uphole recompletes, and artificial lift installations to increase production and develop our reserves.

We maximize cash flow by optimizing our base production while maintaining safe and responsible operations. We utilize technology to increase production and reduce costs, allowing us to increase cash flow by focusing on what moves the needle. We utilize real time monitoring of our assets allows us to reduce troubleshooting time, recover production quickly, and give us earlier warning signs of safety or environmental issues. Maintaining safe and responsible operations is paramount and allows us to remain the preferred partner of operators looking to divest.

Being a responsible operator includes retiring assets at the end of their useful life. After optimizing production and reducing costs, we aim to divest the assets. When divesting is not the way forward, we focus on keeping wells producing and optimized as long as their are remaining reserves. After the reserves are depleted, we plug and abandon the wells and restore the land to its native state, working with landowners so they can enjoy their land for decades to come.

Our Values

Our President

Richard is the Founder and President of Lucky Lad Energy.

Prior to founding Lucky Lad, Richard was an Operations Engineer for Hilcorp Energy where he managed 6,750 BOED across 5 fields along the Louisiana Gulf Coast, valued at over $240 million. He developed and supervised capital and wellwork programs within a $40 million budget and created over $200 million in asset value in the first two years. In three years, he implemented four waterfloods increasing field production by 1,280 BOED and field value by 22% ($52.8 million) by adding 4.5 million barrels of reserves.

Prior to Hilcorp, Richard was employed by Merit Energy where he managed Merit’s Permian Basin and newly-acquired Oklahoma assets. He created capital and operating budgets and developed wellwork and capital programs to increase and optimize production. In two years, Richard was able to increase field value by 29% and $15 million by driving production up and reducing operating costs.

Richard began his career as an Operations Engineer for BP America. He has experience operating mature assets in the San Juan Basin, Permian Basin, Anadarko Basin, and the Gulf Coast Basin.

Richard earned his BS degree in Petroleum Engineering from the University of Oklahoma and his MBA from Louisiana State University. He is also a Registered Professional Engineer in the State of Texas.